When I was invited to a meeting in the metaverse, my heart sank a little. Was it fear of the unknown or fighting the buzz and all-round obsession with the Metaverse? Who knows?

We do know that we must embrace the ‘Future of work’. Be that hybrid or fully remote. Let’s be honest, the likelihood of many of us ever coming back into the office five days a week is slim. And most of us are happy about that. So, it’s no surprise that the use of technology to bring us all virtually together – even if we are physically far apart – is being explored.

So back to the metaverse. What exactly is it? In summary, the “metaverse” describes a fully realised digital world that exists beyond the one in which we live. Impressive hey!? Well, perhaps it is not quite as “wow” as you think. The metaverse is not new at all. It actually just hit its 30th birthday. The word was first coined in Neal Stephenson’s 1992 science fiction novel Snow Crash, but then it was still just an idea. It came more into fruition just over a decade later in 2003 with the launch of Second Life.

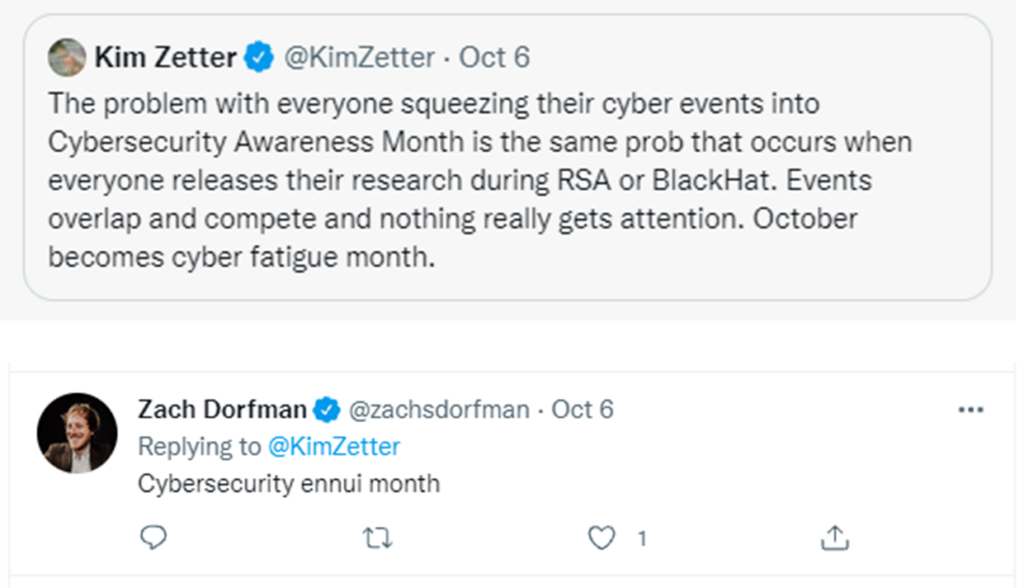

So, if it’s been around for a while, why now are we seeing so much chatter?

Google is an excellent barometer of consumer sentiment and interest. I googled ‘Why is everyone…’ and it automatically suggested ‘Why is everyone talking about metaverse’. So, I guess everyone is asking the same question.

Anyway, back to my meeting. I sat at my home office desk as normal and joined my metaverse meeting with my talented colleagues at Splendid UNLIMITED. Connecting on Horizon Workrooms, we talked all about the potential of this technology. Although still in beta phase, the Workrooms world truly showcased to me the opportunities to interact with people be those colleagues, clients, suppliers ‘in-person, from home’. Then we left the virtual office and played some metaverse mini golf!

Now, don’t get me wrong it felt very strange to be sitting at my desk wearing a headset. But really… what is normal anymore? The metaverse has the potential to unlock some truly incredible opportunities. It is admittedly early days – headsets are still pricey and supplying an entire workforce with them might be a pipedream – but competition, innovation and time will help.

Many big-name brands are already onboard. Microsoft is positioning its products for better business collaboration in the metaverse, McDonald’s recently filed several trademark applications (including one for a virtual restaurant that would deliver to an actual home!), and just last week at Mobile World Congress HTC unveiled its ‘Viverse’ vision of the metaverse.

My view is that any innovation which brings people together is brilliant and must be explored and embraced. In the modern-day, where most of us are working flexibly, communication channels that allow us to collaborate in fun ways should be championed.

My Metaverse meeting was memorable for all the right reasons. I’m excited to see how the technology develops and the creativity it inspires.

So, drop me a line, let’s meet up in the Metaverse… and play some mini golf!